The Crypto Class Salesforce is a concise and accurate course on cryptography in the Salesforce platform, covering essential concepts and practical applications. In this introductory course, you will gain a solid understanding of the fundamentals of cryptography and how it is implemented within the Salesforce ecosystem.

You’ll explore various cryptographic techniques such as symmetric and asymmetric encryption, hashing algorithms, digital signatures, and key management. Through hands-on exercises and real-world examples, you will learn how to use Salesforce’s built-in cryptographic functions and secure your data effectively. Whether you’re a Salesforce administrator, developer, or security professional, this course will equip you with the knowledge and skills to protect sensitive information and ensure data privacy in your Salesforce environment.

Understanding Crypto Trading On Salesforce

Discover how to navigate the world of crypto trading with the Crypto Class Salesforce, a comprehensive program designed to help you understand the ins and outs of this exciting digital market. Gain valuable insights and develop the skills needed to succeed in this ever-evolving industry.

Cryptocurrency trading has gained significant traction in recent years, with investors and enthusiasts constantly seeking efficient platforms to facilitate their trading activities. Salesforce, a renowned customer relationship management (CRM) platform, has emerged as an ideal choice for crypto trading. Let’s dive deeper into the benefits and basics of crypto trading, and explore why Salesforce stands out as the perfect platform for this digital endeavor.

Benefits And Basics Of Crypto Trading:

- 24/7 Market Access: Crypto trading on Salesforce allows you to capitalize on round-the-clock market opportunities in the volatile cryptocurrency world.

- Global Accessibility: As an online platform, Salesforce enables you to trade cryptocurrencies from anywhere in the world, eliminating the geographical limitations imposed by traditional financial markets.

- Increased Liquidity: Cryptocurrency markets are highly liquid, meaning there is a constant stream of buyers and sellers. By trading crypto on Salesforce, you gain access to a vast network of potential counterparties, improving your chances of executing trades quickly.

- Diversification Opportunities: The cryptocurrency market offers a wide range of digital assets, providing ample opportunities for diversification within your trading portfolio. Salesforce allows you to easily explore and invest in various cryptocurrencies, ensuring a diverse investment strategy.

- Transparency and Security: Salesforce’s robust security measures, including encryption and advanced authentication systems, ensure the safety of your crypto assets. Furthermore, blockchain technology’s inherent transparency fosters trust and reduces the risk of fraudulent activities.

- Real-Time Data and Analysis: The Salesforce platform equips you with real-time market data, charts, and analytics tools, enabling prompt decision-making. Stay informed about price movements, trading volumes, and market trends to make well-informed trading choices.

- Automated Trading Strategies: Salesforce supports the integration of advanced trading bots and algorithms, allowing you to automate your trading strategies. This feature enables you to execute trades based on predetermined parameters, maximizing efficiency and potentially minimizing human error.

Why Salesforce Is The Ideal Platform For Crypto Trading:

- Seamless Integration: Salesforce offers seamless integration with various cryptocurrency exchanges and trading platforms. This integration brings together essential tools and functionalities within a unified interface, streamlining trading activities.

- Customizable Dashboards: Salesforce allows you to personalize your trading workspace by creating custom dashboards. Tailor your interface to display relevant information, charts, and indicators that suit your trading preferences, providing a comfortable and efficient trading experience.

- Robust Order Management: With Salesforce’s advanced order management capabilities, you can easily execute various types of orders, including market orders, limit orders, and stop-loss orders. These features allow for precise trade execution and risk management.

- Efficient Communication: Salesforce’s CRM capabilities facilitate seamless communication between traders, enabling collaboration and knowledge-sharing within the crypto trading community. Connect with like-minded individuals, stay updated with industry news, and learn from experienced traders.

Crypto trading on Salesforce offers numerous benefits, including 24/7 market access, global accessibility, increased liquidity, diversification opportunities, transparency, and security. With its seamless integration, customizable dashboards, robust order management, and efficient communication tools, Salesforce emerges as an ideal platform for traders seeking a comprehensive and user-friendly experience in the dynamic world of cryptocurrency trading.

Salesforce’S Crypto Class: Key Features And Benefits

Salesforce’s Crypto Class offers a range of key features and benefits for users interested in cryptocurrency. Gain a deeper understanding of blockchain technology and its potential applications in the business world, while staying ahead of emerging trends in digital finance.

Improve your knowledge and make informed decisions in this rapidly evolving industry.

Salesforce’s Crypto Class offers a comprehensive curriculum designed to help individuals unlock the secrets of crypto trading. This engaging course equips participants with the knowledge and skills necessary to navigate the complex world of cryptocurrency successfully. From an overview of Salesforce’s Crypto Class to exploring its key features and benefits, let’s dive into what makes this program stand out:

Overview Of Salesforce’S Crypto Class

- Expert-led Learning: The Crypto Class is taught by industry-leading professionals who bring years of experience and expertise to the classroom.

- Real-world Applications: Participants gain practical knowledge and insights into crypto trading strategies that can be applied in real-world scenarios.

- Hands-on Experience: The course includes interactive exercises and simulations, allowing participants to practice their newfound skills in a risk-free environment.

- Self-paced Learning: The program offers flexibility, allowing participants to learn at their own pace and schedule, ensuring optimal engagement and retention of knowledge.

- Updated Curriculum: The Crypto Class curriculum is regularly updated to reflect the latest trends and developments in the crypto market, ensuring participants stay ahead of the curve.

How The Crypto Class Helps Unlock Crypto Trading Secrets

- Understanding Crypto Basics: Participants receive a comprehensive foundation in cryptocurrency, including its history, underlying technology, and different types of digital assets.

- Technical Analysis: The course delves into the technical aspects of crypto trading, equipping participants with tools and strategies to analyze price charts and make informed trading decisions.

- Risk Management: To succeed in crypto trading, risk management is crucial. The Crypto Class provides in-depth training on managing risk, including setting stop-loss orders and implementing proper position sizing.

- Trading Psychology: The program explores the psychological aspects of trading, helping participants develop the right mindset and emotional discipline necessary for success in the volatile crypto market.

Examining The Curriculum And Learning Materials

The curriculum of Salesforce’s Crypto Class is thoughtfully designed to cover various aspects of crypto trading, ensuring participants receive a well-rounded education. Here’s an overview of the key learning materials:

- Video Lectures: Engaging video lectures allow participants to learn from industry professionals, as they dive deep into various topics related to cryptocurrency trading.

- Interactive Quizzes: Regular quizzes help reinforce key concepts and ensure participants have a solid understanding of the material covered.

- Case Studies: The Crypto Class includes real-life case studies that illustrate the application of trading strategies in different market conditions, enhancing participants’ critical thinking and problem-solving abilities.

- Resource Materials: Participants gain access to a wealth of resource materials, including e-books, whitepapers, and research papers, providing them with additional insights and knowledge to enhance their learning journey.

With its comprehensive curriculum, expert instructors, and practical learning materials, Salesforce’s Crypto Class stands as a leading choice for individuals looking to unlock the secrets of crypto trading. Whether you’re a beginner or an experienced trader, this program can provide the knowledge and skills necessary to thrive in the exciting world of cryptocurrency.

How To Get Started With Crypto Trading On Salesforce

New to crypto trading? Learn how to get started with Crypto Class Salesforce and navigate the world of cryptocurrency trading on the Salesforce platform. Discover tips and techniques to make informed trading decisions in this comprehensive guide.

Setting Up Your Salesforce Account For Crypto Trading:

To get started with crypto trading on Salesforce, you first need to set up your Salesforce account specifically for this purpose. Here are the steps to follow:

- Sign in to your Salesforce account and navigate to the Setup page.

- Enable the Salesforce Financial Services Cloud using the Lightning App Builder.

- Configure the necessary permissions and access levels for crypto trading.

- Customize your dashboard to include relevant crypto trading components and widgets.

- Connect your Salesforce account to a reliable and secure cryptocurrency exchange platform.

- Set up two-factor authentication for added security.

Exploring The Trading Tools And Features:

Once your Salesforce account is set up for crypto trading, it’s essential to understand the various tools and features at your disposal. Here’s what you can expect:

- Real-time market data: Access up-to-date information on cryptocurrency prices, trends, and market conditions.

- Trading indicators: Utilize technical analysis tools such as moving averages, Bollinger Bands, and RSI to make informed trading decisions.

- Order types: Explore a range of order types including market orders, limit orders, stop orders, and trailing stop orders.

- Portfolio tracking: Monitor your crypto holdings, transactions, gains, and losses within Salesforce.

- Risk management: Implement risk management strategies such as setting stop-loss orders and profit targets.

- Social trading: Connect with other crypto traders, share insights, and follow successful traders’ strategies.

Understanding The Crypto Trading Workflow:

To trade cryptocurrencies effectively, it’s crucial to understand the workflow involved. Here’s a step-by-step breakdown:

- Market analysis: Conduct thorough research on different cryptocurrencies, their performance, and associated risks.

- Trade planning: Define your trading goals, risk tolerance, and desired investment horizon.

- Order placement: Execute your trading strategy by placing buy or sell orders based on your analysis.

- Monitoring and adjustments: Continuously monitor market conditions and make necessary adjustments to your trades as per your trading plan.

- Profit realization: Exit positions and take profits based on predefined targets or when the market conditions meet your expectations.

- Risk management: Regularly assess and manage the risk associated with your crypto trading activities.

With these essential steps in mind, you are now equipped to embark on your crypto trading journey using Salesforce. Remember to stay updated with the latest cryptocurrency news and market trends to make informed trading decisions for better outcomes.

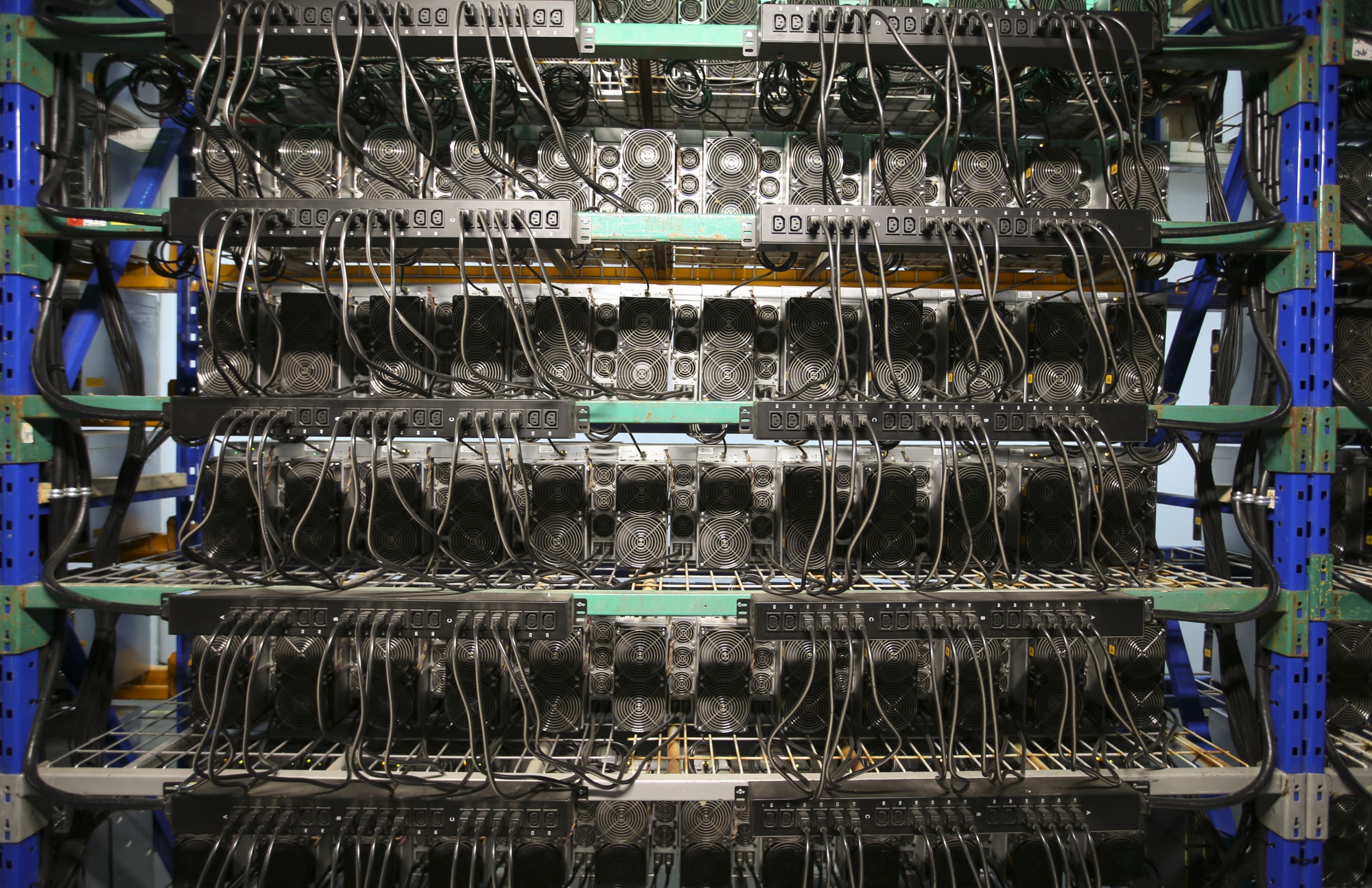

Credit: www.bloomberg.com

Step 1: Account Setup And Security Measures

Get started with the Crypto Class Salesforce by creating your account and implementing essential security measures to protect your information. Safeguard your crypto investments with this step-by-step process.

Creating A Secure And Private Account

Ensuring the security and privacy of your crypto class Salesforce account should be your top priority. To help you get started on the right track, follow these steps to set up your account securely and establish solid security measures.

Enabling Two-Factor Authentication

One of the most effective ways to enhance the security of your crypto class Salesforce account is by enabling two-factor authentication (2FA). By implementing this additional layer of security, you significantly reduce the risk of unauthorized access. Here’s how you can enable 2FA:

- Access your account settings and locate the Two-Factor Authentication section.

- Choose your preferred method for receiving authentication codes, such as SMS, email, or authentication apps like Google Authenticator or Authy.

- Follow the instructions provided to set up and verify your selected method.

- Once set up, each time you log in, you will be prompted to enter a code generated by your chosen authentication method, in addition to your regular password.

Enabling 2FA provides an extra level of protection for your account, ensuring that even if someone gains access to your password, they won’t be able to log in without the additional authentication code.

Best Practices For Password Management

Effective password management plays a crucial role in securing your crypto class Salesforce account. By following these best practices, you can create strong, unique passwords and minimize the risk of unauthorized access:

- Create a unique password: Avoid reusing passwords across multiple accounts. Each account should have its own distinct, strong password.

- Use a combination of characters: Include a mix of uppercase and lowercase letters, numbers, and special characters in your password. This makes it more difficult to crack.

- Make it lengthy: Aim for a minimum password length of 12 characters. The longer the password, the harder it is to guess or crack.

- Change passwords regularly: Set a reminder to change your password periodically. This reduces the risk of a compromised password being used to access your account.

- Avoid predictable patterns: Refrain from using easily guessable information like your name, birthdate, or commonly used words in your passwords.

- Consider a password manager: Using a reputable password manager can help generate and securely store complex passwords, making it easier to manage multiple accounts.

Implementing these password management best practices significantly strengthens the security of your crypto class Salesforce account, ensuring that your sensitive information remains protected.

Remember, proactive account setup and robust security measures are essential to safeguarding your crypto assets and personal information. By following these steps and best practices, you can establish a secure and private account, minimizing the risk of unauthorized access.

Step 2: Navigating The Crypto Trading Tools

Learn to navigate the crypto trading tools in Step 2 of the Crypto Class Salesforce. Discover how to efficiently use these tools for successful cryptocurrency trading.

Welcome back to our Crypto Class Salesforce series! Now that you have a basic understanding of cryptocurrencies and how to get started with crypto trading, it’s time to delve into the world of crypto trading tools. In this step, we will guide you through the process of navigating these tools, helping you make informed decisions and optimize your trading strategies.

Introduction To The Crypto Trading Dashboard

To effectively trade cryptocurrencies, you need a reliable trading platform with a user-friendly interface. The crypto trading dashboard is your go-to tool for executing trades and tracking your investments. Here’s what you need to know:

- Real-time Market Data: The dashboard provides you with up-to-date market prices and allows you to monitor fluctuations in real-time. Stay informed about price movements, trading volumes, and other crucial market indicators.

- Order Placement and Execution: Easily place buy or sell orders directly from the trading dashboard. Set the desired price, quantity, and type of order, and let the platform handle the execution. Seize trading opportunities and respond quickly to market changes.

- Charting and Technical Analysis: Analyzing market trends and patterns is essential for successful trading. The trading dashboard offers a range of charting tools and technical indicators to help you identify potential entry and exit points. Utilize these tools to gain insights into market dynamics.

Analyzing Market Data And Trends

Understanding market data and trends is a key component of crypto trading. The trading tools at your disposal can assist you in analyzing this information effectively. Here’s what you need to keep in mind:

- Historical Price Data: Access past price data for various cryptocurrencies, enabling you to identify historical trends and patterns. Historical data can help you make more informed trading decisions by understanding how prices have behaved in the past.

- Technical Indicators: These indicators, such as moving averages, MACD, and RSI, can help you identify potential entry and exit points. Analyzing trends and patterns through technical analysis can assist in predicting future market movements.

- Market News and Sentiment Analysis: Stay updated with the latest news and announcements that can impact cryptocurrency prices. By combining fundamental analysis with sentiment analysis, you can gain insights into market behavior and make informed trading decisions.

Monitoring Cryptocurrency Portfolios

As a crypto trader, it’s crucial to keep track of your cryptocurrency portfolios. The trading tools provided by the platform can help you monitor and manage your investments effectively. Here are the key features:

- Portfolio Overview: Get a comprehensive view of your cryptocurrency holdings, including current prices, portfolio value, and distribution. Analyze your portfolio’s performance and make necessary adjustments to optimize your investment strategy.

- Performance Tracking: Monitor the performance of individual cryptocurrencies within your portfolio. Keep track of gains and losses, compare performance against various benchmarks, and evaluate the success of your trading strategies.

- Alerts and Notifications: Set up personalized alerts and notifications to stay updated with price movements, significant market events, and changes in portfolio value. These alerts can help you make timely decisions and take advantage of trading opportunities.

In this step, we explored the essential aspects of navigating the crypto trading tools. By utilizing the trading dashboard, analyzing market data and trends, and monitoring your cryptocurrency portfolios, you’re equipped with the necessary tools to trade with confidence. Now, let’s move on to step three, where we’ll discuss risk management strategies in crypto trading.

Step 3: Placing Trades And Managing Investments

Learn how to place trades and effectively manage your investments through the Crypto Class Salesforce. Gain insight into the world of cryptocurrency and take control of your financial future.

Crypto Class Salesforce

Are you ready to take the next step in your crypto trading journey? In step 3 of our Crypto Class Salesforce series, we will explore the essential aspects of placing trades and managing investments. This crucial step will equip you with the necessary knowledge to execute your trades effectively and make informed investment decisions.

Let’s dive right in:

Placing Buy And Sell Orders

When it comes to executing trades in the crypto market, it is essential to understand how to place buy and sell orders. Here are the key points to consider:

- Market Order: A market order is the simplest type of order, where you buy or sell a cryptocurrency at the prevailing market price.

- Limit Order: With a limit order, you specify the price at which you want to buy or sell a cryptocurrency. The order will be executed only if the market reaches your specified price.

- Stop Order: A stop order is used to limit potential losses or protect profits. It triggers a market order when a specific price level, called the stop price, is reached.

Setting Stop-Loss And Take-Profit Levels

One of the smartest strategies in crypto trading is setting stop-loss and take-profit levels. These levels help you manage risks and secure profits. Here’s what you need to know:

- Stop-Loss Level: A stop-loss level is the price at which you decide to exit a trade to limit potential losses. By setting a stop-loss level, you can minimize the impact of market downturns on your investments.

- Take-Profit Level: A take-profit level is the price at which you choose to close a trade and secure your target profit. This level ensures that you don’t miss out on potential gains.

Portfolio Diversification Strategies

Diversifying your crypto investment portfolio is an effective way to reduce risk and maximize potential returns. Consider the following strategies:

- Spread Investments: Allocate your investments across various cryptocurrencies to minimize the impact of any single asset’s performance.

- Consider Different Sectors: Invest in cryptocurrencies from different sectors or industries. This diversification helps you navigate market fluctuations more effectively.

- Set Allocation Targets: Define the percentage of your portfolio you allocate to different cryptocurrencies. Regularly rebalance your portfolio to maintain your desired allocation.

Step 3 of our Crypto Class Salesforce series has explored the crucial aspects of placing trades and managing investments in the crypto market. By understanding how to place buy and sell orders, setting stop-loss and take-profit levels, and implementing portfolio diversification strategies, you can enhance your trading skills and optimize your investment outcomes.

Get ready to take your crypto journey to new heights!

Advanced Strategies For Successful Crypto Trading On Salesforce

Discover advanced strategies for successful crypto trading on Salesforce with the comprehensive Crypto Class. Enhance your knowledge and skills in crypto trading to achieve optimal results on the Salesforce platform.

Crypto trading on Salesforce can be a complex endeavor, but with advanced strategies, you can increase your chances of success. In this section, we will explore two key aspects of successful crypto trading: technical analysis and charting tools, as well as evaluating fundamental factors and news.

Additionally, we will discuss how to implement risk management techniques to protect your investments. Let’s dive in!

Technical Analysis And Charting Tools

- Utilize candlestick charts: These charts provide valuable insights into market trends and patterns, helping you make informed trading decisions.

- Identify support and resistance levels: By analyzing historical price data, you can pinpoint levels at which the price tends to find support and resistance, allowing you to enter and exit trades at advantageous levels.

- Use moving averages: These indicators can help you identify trends and potential reversals, providing clear signals for buying or selling.

- Incorporate oscillators: Oscillators such as the Relative Strength Index (RSI) or Stochastic Oscillator can help you gauge overbought and oversold conditions, indicating potential price reversals.

- Apply chart patterns: Chart patterns like triangles, head and shoulders, or double tops/bottoms can signal potential trend continuations or reversals, offering valuable insights for trading decisions.

Evaluating Fundamental Factors And News

- Stay updated with cryptocurrency news: Keeping abreast of the latest news and developments in the crypto industry is crucial for successful trading. This includes staying informed about regulatory changes, technological advancements, and partnerships within the crypto space.

- Assess market sentiment: Understanding market sentiment can provide you with a sense of overall market direction. Monitoring social media discussions, sentiment analysis tools, or news sentiment indicators can help gauge the collective mood of traders and investors.

- Analyze fundamental factors: Consider factors such as project team, technology, adoption, competition, and market demand. Determine whether a particular cryptocurrency has strong fundamentals and long-term potential, as this can significantly influence its price movement.

- Look for catalysts: Identify potential news events or market catalysts that could impact the price of a cryptocurrency. Partnership announcements, product launches, or institutional investments are examples of catalysts that can drive significant price movements.

Implementing Risk Management Techniques

- Set stop-loss orders: A stop-loss order automatically triggers a market order to sell your cryptocurrency if its price drops to a specified level. This can help limit potential losses in volatile markets.

- Determine risk-reward ratios: Calculate the potential reward and risk of a trade before entering. By setting a minimum acceptable risk-reward ratio, you can ensure that potential profits outweigh potential losses.

- Diversify your portfolio: Allocate your investments across different cryptocurrencies to spread risk. This helps protect you from a significant loss if one particular cryptocurrency underperforms.

- Use position sizing: Determine the appropriate position size for your trades based on your risk tolerance. Never risk more than you can afford to lose on any single trade.

By incorporating these advanced strategies into your crypto trading on Salesforce, you can make well-informed decisions based on both technical and fundamental analysis. Moreover, implementing risk management techniques will help protect your capital and minimize potential losses. Remember to keep learning and adapting as the crypto market is continuously evolving.

Happy trading!

Troubleshooting And Common Challenges In Crypto Trading On Salesforce

Discover troubleshooting techniques and overcome common challenges in crypto trading using Salesforce’s innovative Crypto Class. Gain insights into effective strategies to navigate the complexities of the cryptocurrency market and optimize your trading experience.

Crypto trading on Salesforce can be a profitable venture, but it’s not without its challenges. Troubleshooting and overcoming common issues can help traders navigate the complexities of the market. In this section, we’ll explore some of the most common trading mistakes, techniques for dealing with volatility and market manipulation, and strategies to overcome technical issues and platform glitches.

Common Trading Mistakes And How To Avoid Them:

- Lack of research: Conduct thorough research on the cryptocurrency you plan to trade, including its fundamentals, market trends, and potential risks.

- Emotional trading: Avoid making impulsive decisions based on fear or greed. Stick to a solid trading strategy and don’t let emotions cloud your judgment.

- Overtrading: Trade strategically and don’t get caught up in the excitement of multiple transactions. Overtrading can lead to losses and mistakes.

- Ignoring risk management: Implement risk management strategies, such as setting stop-loss orders and diversifying your portfolio, to protect your capital.

- Failing to analyze past trades: Review your previous trades to identify patterns, learn from mistakes, and refine your trading strategy.

Dealing With Volatility And Market Manipulation:

- Stay updated with news and market information: Stay informed about market trends, news, and events that may impact cryptocurrency prices. This knowledge can help you make informed decisions during volatile periods.

- Utilize technical analysis tools: Technical indicators and charts can help you identify patterns, trends, and potential price reversals, aiding in making more accurate trading decisions.

- Diversify your portfolio: By investing in a variety of cryptocurrencies, you can spread the risk and reduce the impact of volatility on any single asset.

- Be cautious of market manipulation: Research and understand the signs of market manipulation, such as pump-and-dump schemes, and be cautious when trading during periods of high volatility.

Overcoming Technical Issues And Platform Glitches:

- Choose a reliable platform: Before initiating trades, ensure that you’re using a reputable and secure trading platform with strong customer support to minimize technical issues.

- Test the platform’s functionality: Familiarize yourself with the platform’s features and test its functionality before trading with real money. This can help you identify any potential glitches or issues.

- Stay up to date with platform updates: Keep track of any platform updates or patches released by the provider. Updating your software can resolve technical issues and improve trading performance.

- Seek assistance from customer support: If you encounter any technical issues or glitches during trading, reach out to the platform’s customer support for assistance. They can guide you in troubleshooting and resolving the problem.

By avoiding common trading mistakes, being prepared for volatility and market manipulation, and proactively addressing technical issues, crypto traders can enhance their chances of success on the Salesforce platform. Remember, continuous learning, adaptability, and resilience are vital for surviving and thriving in the ever-evolving world of crypto trading.

Tips For Maximizing Profits And Minimizing Risks In Crypto Trading

Learn effective strategies to maximize profits and minimize risks in crypto trading through our Crypto Class Salesforce. Discover proven tips from industry experts to navigate the volatile cryptocurrency market and make informed trading decisions. Accelerate your success in crypto trading today.

Crypto trading can be a thrilling yet challenging venture, with the potential for both significant profits and risks. To navigate this volatile market successfully, it’s crucial to have a solid trading plan, manage emotions effectively, and constantly monitor and adjust your trading strategies.

In this section, we will explore these key elements and provide tips for maximizing profits while minimizing risks in crypto trading.

Building A Solid Trading Plan

- Clearly define your goals and risk tolerance: Before you start trading, establish your financial objectives and determine how much risk you are willing to take. This will help guide your decision-making process and prevent impulsive actions based on emotions.

- Research and analyze the market: Stay up-to-date with the latest news, trends, and developments in the crypto market. Conduct thorough research and analyze historical data to identify potential opportunities and make informed trading decisions.

- Set realistic expectations: Crypto trading can be highly unpredictable, so it’s important to set realistic expectations. Understand that there will be ups and downs, and avoid falling prey to get-rich-quick schemes.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your crypto investments across different coins or tokens to minimize the impact of potential losses from a single asset.

- Use proper risk management strategies: Implement risk management techniques like stop-loss orders and take-profit orders to limit your potential losses and secure profits. This will help protect your capital and reduce the impact of market volatility.

Managing Emotions And Staying Disciplined

- Avoid emotional decision-making: Emotions such as fear and greed can cloud your judgment and lead to impulsive trading decisions. Learn to control your emotions and base your actions on rational analysis and strategy.

- Stick to your trading plan: Once you have established a trading plan, stick to it. Avoid deviating from your strategy based on short-term market fluctuations or FOMO (fear of missing out). Consistency and discipline are key to long-term success.

- Practice risk management: Embrace the mindset of preserving capital rather than chasing quick gains. Set predefined stop-loss levels and exit points to protect yourself from significant losses.

- Take regular breaks: Crypto trading can be intense and emotionally draining. Take regular breaks to recharge and clear your mind. This will help you maintain objectivity and make better decisions.

- Learn from mistakes: Accept that losses are a part of trading and view them as learning opportunities. Analyze your mistakes, understand what went wrong, and make necessary adjustments to improve your future trading strategies.

Monitoring And Adjusting Trading Strategies

- Invest in a solid trading platform: Choose a reliable platform that provides real-time data, advanced charting tools, and order execution capabilities. This will enable you to monitor the market effectively and execute trades promptly.

- Analyze trading patterns and adjust strategies accordingly: Continuously monitor the performance of your trading strategies and analyze patterns in your trades. Identify areas for improvement, tweak your strategies, and adapt to changing market conditions.

- Keep a trading journal: Maintain a detailed record of your trades, including entry and exit points, reasons for making specific trades, and the outcome. This will help you identify patterns, assess the effectiveness of your strategies, and make data-driven decisions.

- Stay informed about regulatory changes: The crypto market is subject to evolving regulations. Stay informed about any changes in crypto-related regulations that may impact your trading activities. Compliance with regulatory requirements is essential for long-term success in the crypto trading sphere.

- Continuously educate yourself: Crypto trading is a dynamic field with new developments emerging regularly. Stay updated with the latest industry news, attend webinars, read books, and follow reputable sources to enhance your knowledge and keep evolving as a trader.

By building a solid trading plan, managing emotions effectively, and continuously monitoring and adjusting your trading strategies, you can increase your chances of maximizing profits while minimizing risks in the world of crypto trading. Remember, success in this field requires discipline, patience, and a commitment to ongoing learning and improvement.

Conclusion And Next Steps

Discover the next steps after completing the Crypto Class Salesforce, paving the way for a deeper understanding of crypto and its applications. Gain valuable insights, master the fundamentals, and unlock new possibilities in the world of cryptocurrency. Let your crypto journey unfold with these recommended next steps.

Crypto Class Salesforce is an incredibly insightful and practical guide to leveraging Salesforce for crypto trading. In this blog post, we’ll recap the key points discussed, share final thoughts on crypto trading with Salesforce, and provide resources for further learning and improvement.

Recap Of Key Points Discussed:

- Integration of third-party crypto data into Salesforce: Salesforce offers seamless integration with different crypto data providers, allowing you to access real-time market data, track trends, and make informed trading decisions.

- Building custom objects and fields: By creating custom objects and fields in Salesforce, you can tailor the platform to suit your specific crypto trading needs. This customization enables you to efficiently manage your portfolios and analyze performance.

- Automating trade execution: Utilizing Salesforce’s automation capabilities, you can automate trade execution based on predefined conditions. This helps you take advantage of market opportunities promptly and minimize manual effort.

- Reporting and analytics: Salesforce’s reporting and analytics tools empower you to generate comprehensive reports, visualize data, and gain valuable insights into your trading activities. This data-driven approach enables you to refine your strategies and optimize performance.

Final Thoughts On Crypto Trading With Salesforce:

Crypto trading with Salesforce offers immense potential for streamlining processes, increasing efficiency, and enhancing decision-making. By harnessing the power of Salesforce’s extensive features, you can gain a competitive edge in the fast-paced world of cryptocurrency. However, it’s important to continually adapt and stay updated with the evolving crypto landscape to maximize the benefits Salesforce brings to your trading endeavors.

Resources For Further Learning And Improvement:

- Salesforce Trailhead: Explore the dedicated Salesforce Trailhead modules on crypto trading and investment management. These interactive lessons provide step-by-step guidance on leveraging Salesforce for crypto trading and offer hands-on experience.

- Community engagement: Engage with the Salesforce Trailblazer community to connect with fellow crypto traders and industry experts. Collaborate, exchange ideas, and gain valuable insights from peers who have successfully integrated Salesforce into their trading strategies.

- Online courses: Consider enrolling in online courses that focus on Salesforce and crypto trading. These courses provide in-depth knowledge and practical skills to enhance your proficiency in both areas.

- Industry blogs and forums: Stay up to date with the latest trends, news, and best practices by following reputable crypto trading blogs and participating in relevant forums. This allows you to tap into the collective wisdom of experienced traders and stay ahead of the curve.

With a solid understanding of the key concepts discussed in Crypto Class Salesforce, you are now equipped to leverage Salesforce for more efficient and effective crypto trading. Continually expanding your knowledge and honing your skills will enable you to stay ahead in this dynamic industry.

Remember, mastering crypto trading with Salesforce requires continuous learning, practical application, and exploring new strategies. Embrace growth, embrace change, and keep pushing the boundaries of what’s possible in the world of crypto trading with Salesforce.

Frequently Asked Questions For Crypto Class Salesforce

What Is Crypto Class Salesforce And How Does It Work?

Crypto Class Salesforce is a platform that offers comprehensive training on cryptocurrency and blockchain technology to Salesforce professionals. It covers topics like crypto fundamentals, blockchain integration, and crypto strategies for business growth. Participants gain practical knowledge through hands-on projects and real-world examples.

What Are The Benefits Of Taking A Crypto Class Salesforce?

By taking a Crypto Class Salesforce, individuals can enhance their understanding of cryptocurrency and blockchain technology. This knowledge can help them leverage these technologies to drive innovation, improve customer experiences, and explore new business models. It also opens up career opportunities in the fast-growing digital economy.

Are There Any Prerequisites For Crypto Class Salesforce?

No prior knowledge of cryptocurrency or blockchain is required for Crypto Class Salesforce. However, a basic understanding of Salesforce and familiarity with cloud computing concepts would be beneficial. The course is designed to cater to both beginners and experienced professionals looking to expand their skillset in this domain.

Conclusion

The Crypto Class Salesforce offers a comprehensive and practical approach to understanding and using cryptocurrency in the context of the Salesforce platform. By participating in this course, individuals can gain valuable insights into the world of digital currencies and how they can be integrated into their business processes.

The course covers a wide range of topics, including the basics of cryptocurrency, blockchain technology, and the various ways in which Salesforce can be utilized to leverage these innovations. Through hands-on exercises and real-life examples, participants can develop the necessary skills to navigate the cryptocurrency landscape confidently.

Whether you are a beginner looking to explore the potential of cryptocurrency or an experienced Salesforce user seeking to enhance your knowledge, this course provides a valuable resource for expanding your expertise. So why wait? Enroll in the Crypto Class Salesforce today and unlock the exciting possibilities that cryptocurrency can bring to your business.