Dot Crypto is a decentralized cryptocurrency that allows for secure and private transactions. In recent years, its price has seen significant fluctuations, making it a popular choice for investors and traders.

The world of cryptocurrency has witnessed an explosion of interest in recent years, with various digital currencies capturing the attention of investors and traders alike. One such cryptocurrency that has gained significant traction is Dot Crypto. Created as a decentralized currency, Dot Crypto provides a secure and private platform for conducting transactions.

Its unique properties have attracted a growing number of individuals looking to invest and trade in this digital asset. We will explore the price trends of Dot Crypto, discussing its recent fluctuations and the factors that influence its value. By gaining an understanding of Dot Crypto’s price movements, investors can make informed decisions about whether to buy, sell, or hold onto this cryptocurrency. So, let us dive into the world of Dot Crypto and examine its ever-evolving price dynamics.

The Potential For Profit In The Dot Crypto Price Market

The Dot Crypto Price market holds immense potential for profit, making it an attractive investment opportunity. Take advantage of the rising popularity and value of dot crypto prices to maximize your earnings.

The Background Of Dot Crypto And Its Significance

- Dot Crypto, also known as .crypto, is a domain extension specifically designed for blockchain-based websites. It operates on the Ethereum blockchain, utilizing smart contracts to facilitate decentralized websites.

- The significance of dot crypto lies in its ability to provide censorship-resistant and immutable websites. Unlike traditional domain extensions like .com or .org, dot crypto domains cannot be seized or controlled by any authority or organization.

- This decentralized nature offers an unprecedented level of freedom, security, and privacy for website owners. Dot crypto domains have gained popularity among blockchain enthusiasts, businesses, artists, and content creators who wish to establish their online presence without the risk of censorship or interference.

Why Investing In Dot Crypto Can Be Lucrative

- The potential for profit in the dot crypto market is immense due to several key factors:

- Limited Supply: The number of available dot crypto domains is finite, which increases their value over time. As more businesses and individuals recognize the benefits of blockchain-based websites, the demand for dot crypto domains is expected to rise, potentially driving up their prices.

- Increasing Adoption: Blockchain technology is gaining widespread adoption across various industries, and dot crypto domains are at the forefront of this revolution. As more businesses and individuals create decentralized websites, the demand for dot crypto domains will continue to grow, presenting an excellent investment opportunity.

- Revenue Generation: Dot crypto domains offer innovative ways to generate revenue. For instance, website owners can monetize their domains through decentralized advertising, content creation, or by selling digital products and services directly on their websites. This potential for revenue generation adds to the investment appeal of dot crypto domains.

- Future Potential: As the blockchain industry evolves and matures, dot crypto domains are poised to become an integral part of the digital landscape. Investing early in this emerging market can position investors to benefit from future advancements and developments in decentralized website technology.

Analyzing The Historical Dot Crypto Price Trends

- Analyzing historical price trends is essential for understanding the potential profitability of investing in dot crypto domains. By studying past market behavior, investors can make more informed decisions. Here are some key insights:

- Increasing Demand: Over the past few years, the demand for dot crypto domains has steadily grown, resulting in price appreciation. As more users and businesses recognize the benefits and potential of blockchain-based websites, this trend is likely to continue.

- Volatility: Like any investment, dot crypto domains are subject to market volatility. The prices of these domains can fluctuate significantly in response to various factors such as market sentiment, regulatory developments, and technological advancements. It is crucial for investors to consider this volatility when entering the dot crypto market.

- Market Maturity: The dot crypto market is relatively new and still evolving. As the market matures, more data and insights will become available, providing investors with additional tools for making informed decisions.

- Long-Term Potential: Despite short-term price fluctuations, many experts believe that dot crypto domains have substantial long-term potential. As the adoption of decentralized websites grows and the benefits of dot crypto become more apparent, the value of these domains is expected to increase steadily.

Investing in dot crypto domains presents a lucrative opportunity due to the limited supply, increasing adoption, potential for revenue generation, and future prospects. However, investors should carefully analyze historical price trends, considering factors such as increasing demand, volatility, and overall market maturity before making investment decisions.

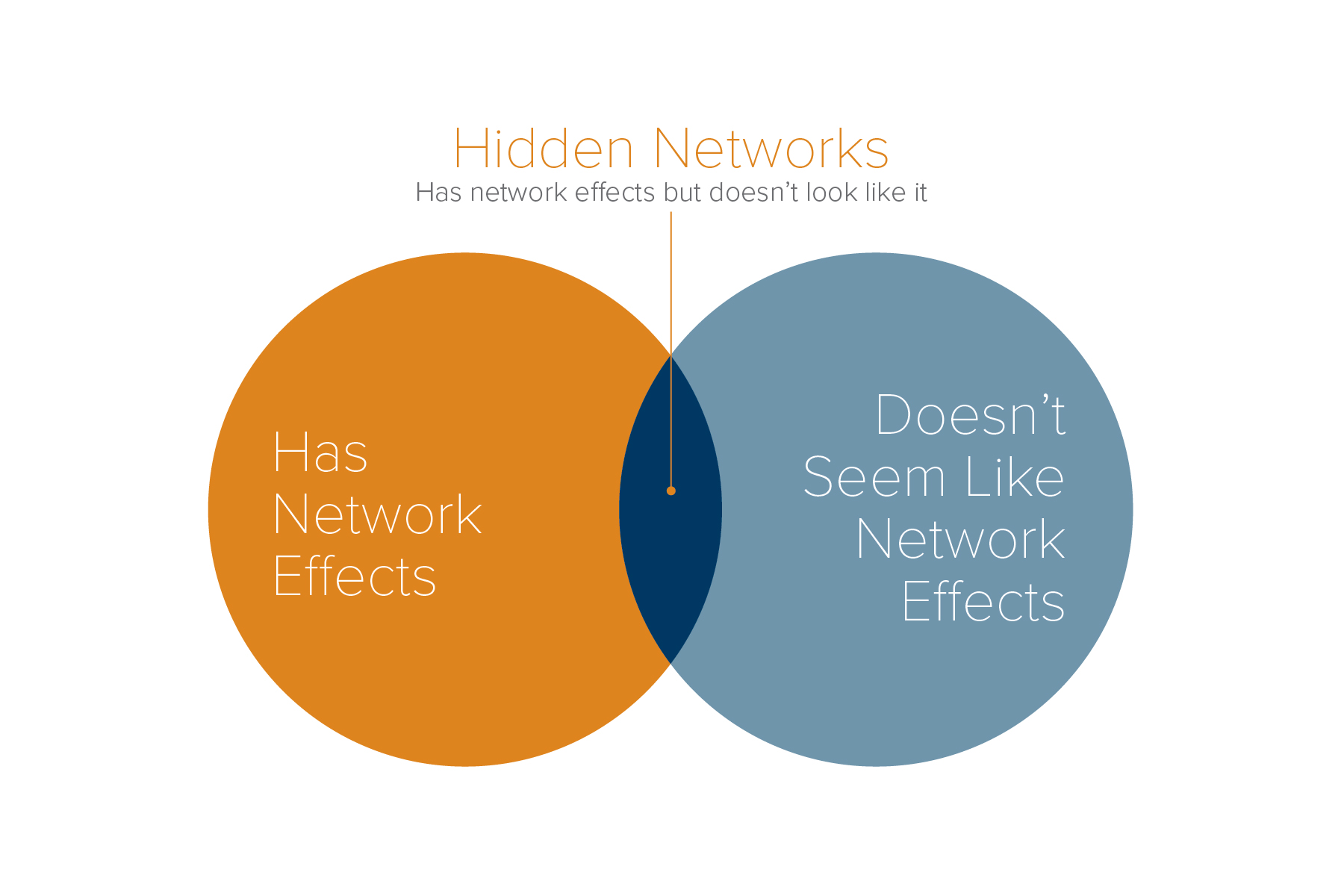

Credit: a16z.com

Factors Influencing The Dot Crypto Price

Factors that impact the price of Dot Crypto include market demand, trading volume, regulatory developments, project updates, and overall cryptocurrency market conditions. Understanding these influences is essential for investors and traders to make informed decisions.

Dot Crypto’S Relationship With Cryptocurrency Market

The price of Dot Crypto is intrinsically tied to the broader cryptocurrency market. As one of the numerous cryptocurrencies available, Dot Crypto is influenced by market trends and sentiments. Here are some key factors that play a role in determining the price of Dot Crypto:

- Market Sentiment: The overall sentiment surrounding cryptocurrencies, including Dot Crypto, greatly impacts its price. Positive news, such as increased adoption or regulatory support, can lead to a surge in demand and subsequently drive the price up. Conversely, negative developments or market volatility may cause a decline in price as investors become cautious.

- Bitcoin’s Influence: Bitcoin has established itself as the leading cryptocurrency and often sets the tone for the entire market, including Dot Crypto. When Bitcoin’s price experiences significant fluctuations, it tends to have a ripple effect on other cryptocurrencies, influencing their prices in tandem.

- Investor Confidence: Investor confidence plays a crucial role in defining the demand for Dot Crypto. If investors perceive the cryptocurrency market as trustworthy and reliable, they are more likely to invest in Dot Crypto, driving up its price. Conversely, a lack of confidence or negative market sentiment can lead to decreased demand and a subsequent drop in price.

- Market Liquidity: The liquidity of Dot Crypto also affects its price. Higher liquidity provides ease of buying and selling, which contributes to stable price movements. Increased trading volumes and the presence of exchanges with high trading activity can positively impact price stability for Dot Crypto.

- Regulatory Changes: Government regulations and policies related to cryptocurrencies can significantly influence the price of Dot Crypto. Favorable regulations that support the growth and adoption of cryptocurrencies generally have a positive impact on prices. Conversely, restrictive regulations or bans may adversely affect the price by creating uncertainty and reducing market participation.

Market Demand And Adoption Of Dot Crypto

The demand for Dot Crypto and its price are closely linked to factors such as market adoption and overall demand for decentralized domains. Here are some key points to consider:

- Domain Ownership Trends: Increasing demand for decentralized domains and the growth of the decentralized web can positively impact the value of Dot Crypto. As more individuals and businesses recognize the benefits of owning a domain that offers enhanced security and decentralization, the demand for Dot Crypto domains increases, potentially leading to higher prices.

- Emerging Use Cases: The emergence of innovative use cases for Dot Crypto can drive demand and influence its price. When individuals and organizations find new and practical applications for Dot Crypto domains, it attracts attention and can lead to increased adoption, ultimately pushing the price higher.

- Awareness and Education: Widespread awareness and education about the benefits and potential of Dot Crypto domains can have a positive impact on the price. As more people become familiar with the advantages of decentralized domains and their potential value, it can drive demand, supporting price growth.

- Competition: The level of competition in the decentralized domain market can also affect Dot Crypto’s price. Marketplaces and alternative domain extensions competing with Dot Crypto may influence its value, as users have multiple options to choose from. Increased competition may lead to price adjustments to attract users and maintain competitiveness.

- Partnerships and Integrations: Collaborations between Dot Crypto and other prominent platforms or projects can significantly impact its price. Strategic partnerships or integrations that expand the usability and reach of Dot Crypto domains often lead to heightened interest and increased demand, potentially driving the price upwards.

Technological Advancements Impacting Dot Crypto Price

Technological advancements play a significant role in shaping the price of Dot Crypto. Here are some key technological factors to consider:

- Network Upgrades: Upgrades to the underlying technology of Dot Crypto, such as improved scalability, security, or governance mechanisms, can positively impact its price. These upgrades enhance the functionality and attractiveness of Dot Crypto domains, leading to increased adoption and demand.

- Developer Activity: Developer activity, including the creation of new tools, applications, or integrations, can enhance the ecosystem surrounding Dot Crypto. As the developer community grows and contributes to expanding use cases and possibilities for Dot Crypto domains, it can positively influence its price.

- Scalability Solutions: Scalability is a crucial factor for the widespread adoption of any blockchain-based project, including Dot Crypto. Technological advancements that address scalability challenges and enable faster, more efficient transactions can make Dot Crypto more attractive to both users and investors, potentially influencing its price.

- Interoperability: The ability of Dot Crypto to interact and integrate with other blockchain projects or networks can impact its price. Increased interoperability enhances the versatility and utility of Dot Crypto domains, potentially attracting more users and driving up demand and price.

- Security Enhancements: Improvements in security measures and protocols surrounding Dot Crypto can have a positive effect on its price. As the level of trust and confidence in the security of Dot Crypto domains increases, more individuals and businesses may be inclined to invest, potentially driving price growth.

Remember, the price of Dot Crypto is influenced by various factors, including market sentiment, demand, adoption, and technological advancements. Understanding these dynamics can help investors and enthusiasts gain insight into the potential price movements of Dot Crypto.

Strategies For Maximizing Profit In Dot Crypto Trading

Maximize profits in dot crypto trading with effective strategies to navigate the ever-changing dot crypto price. Stay ahead of the market by analyzing trends, using technical indicators, and implementing risk management techniques.

Dot Crypto Price:

Cryptocurrency trading has gained significant popularity in recent years, with various digital currencies offering unique opportunities for investors. Dot Crypto, in particular, has emerged as a promising cryptocurrency, attracting the attention of traders worldwide. If you’re looking to maximize your profits in Dot Crypto trading, it’s crucial to develop effective strategies.

In this section, we will explore key strategies to help you navigate the Dot Crypto market successfully.

Identifying The Right Time To Enter The Dot Crypto Market:

- Timing plays a crucial role in the success of any trading endeavor, and Dot Crypto is no exception. Use the following techniques to identify the optimal time to enter the Dot Crypto market:

- Technical analysis: Analyze historical price data, patterns, and indicators to predict future Dot Crypto price movements.

- Market sentiment analysis: Monitor forums, social media platforms, and news sources to gauge the overall sentiment surrounding Dot Crypto.

- Fundamental analysis: Evaluate the underlying factors that may impact Dot Crypto’s value, such as partnerships, technological advancements, and market trends.

- Stay informed and keep a close eye on market conditions to identify favorable entry opportunities.

Technical Analysis Techniques For Predicting Dot Crypto Price Movements:

- Technical analysis involves studying historical price and volume data to predict future movements. Utilize the following techniques to analyze Dot Crypto price trends:

- Moving averages: Track the average price over a specific period to identify the overall trend direction.

- Support and resistance levels: Identify price levels where buying or selling pressure is likely to be significant, helping make informed trading decisions.

- Candlestick patterns: Study different candlestick patterns to understand market psychology and potential price reversals.

- Relative Strength Index (RSI): Monitor the RSI indicator to identify overbought and oversold conditions, indicating potential price corrections.

Risk Management Strategies For Dot Crypto Trading Success:

- Managing risk is essential in any trading activity, including Dot Crypto trading. Implement the following strategies to mitigate risk and increase your chances of success:

- Set stop-loss orders: Define price levels where you are willing to exit a trade to limit potential losses.

- Diversify your portfolio: Spread your investments across multiple cryptocurrencies or different asset classes to reduce the impact of market volatility.

- Start with a demo account: Practice your trading strategies using a demo account before committing real funds, allowing you to gain experience without risking capital.

- Follow strict money management rules: Determine a percentage of your trading capital that you are comfortable risking on each trade and stick to it.

- Stay updated on regulatory and security measures: Understand the legal and security aspects of trading Dot Crypto to protect yourself from potential scams or fraud.

Remember, successful Dot Crypto trading requires continuous learning, adaptability, and discipline. By carefully analyzing market conditions, utilizing technical analysis techniques, and implementing effective risk management strategies, you can improve your chances of maximizing profits in the Dot Crypto market.

Expert Opinions On The Future Of Dot Crypto Price

Experts weigh in on the future of Dot Crypto price, offering valuable insights and opinions. Their expertise sheds light on potential trends and developments that may impact the value of Dot Crypto in the coming months and years. Stay informed with these expert perspectives.

With the sustained growth of the cryptocurrency market, dot crypto, also known as. crypto, has been gaining attention from investors and enthusiasts alike. In this section, we will delve into the expert opinions on the future of dot crypto price.

Let’s explore insights from prominent cryptocurrency analysts, the market sentiments and speculation surrounding dot crypto, and the factors influencing the bullish or bearish outlook of its price.

Insights From Prominent Cryptocurrency Analysts:

- Bullish Outlook:

- Dot crypto has established itself as a promising blockchain domain, experiencing a surge in popularity due to its decentralized and censorship-resistant nature.

- Analysts anticipate that the increasing adoption of blockchain technology and the integration of decentralized applications will drive the demand for dot crypto, potentially pushing its price to unforeseen heights.

- With companies and individuals recognizing the value of securing their online presence using blockchain domains, a positive sentiment towards dot crypto’s future emerges.

- Bearish Outlook:

- Some analysts express concerns over the volatility of the cryptocurrency market, suggesting that dot crypto may face price fluctuations similar to other digital currencies.

- The competitive landscape could also impact dot crypto’s price, as alternative blockchain domains emerge, potentially dividing the market and diluting its value.

- Regulatory uncertainties surrounding cryptocurrencies in general may cast a shadow on the future of dot crypto, leading some experts to take a more cautious stance on its price prospects.

Market Sentiments And Speculation Surrounding Dot Crypto:

- Enhanced Decentralization:

- Dot crypto’s decentralized nature is perceived positively by the market, attracting users who value a censorship-resistant and secure online presence.

- With no central authority governing dot crypto, individuals and businesses can maintain full control over their domain names, reducing dependency on traditional centralized systems.

- Growing Demand:

- The expanding interest in blockchain technology and decentralized applications contributes to the growing demand for dot crypto.

- Companies are beginning to recognize the potential of utilizing blockchain domains to provide additional security and ensure trust for their online presence.

- Potential for Innovation:

- The versatility of dot crypto allows for the development of innovative solutions, enabling users to redefine how they interact with the internet.

- As more real-world applications are built on dot crypto, its perceived value may increase, in turn influencing its price dynamics.

Factors Contributing To The Bullish Or Bearish Dot Crypto Price Outlook:

- Technological Advancements:

- The continuous improvement of blockchain technology and the evolution of decentralized infrastructure can positively impact dot crypto’s price outlook.

- Upgrades and developments that enhance the domain’s functionality, scalability, and interoperability could attract more users, potentially leading to increased demand and price appreciation.

- Regulatory Landscape:

- The regulatory framework surrounding cryptocurrencies can significantly affect dot crypto’s price trajectory. Clear and favorable regulations can instill confidence in investors and facilitate mainstream adoption, driving up its value. Conversely, stringent regulations or unfavorable government actions may hinder its growth potential.

- Market Demand and Adoption:

- Market sentiment, industry trends, and the adoption rate of dot crypto by individuals, businesses, and institutions influence its price outlook.

- Increased exposure, partnerships, and integrations with existing platforms or services can boost dot crypto’s demand and potentially drive its price upwards.

The future of dot crypto’s price remains uncertain, as it is influenced by various factors, expert opinions, and market sentiments. As the cryptocurrency industry continues to evolve, only time will reveal the true potential and direction of dot crypto’s price movement.

Evaluating The Potential Returns On Dot Crypto Investments

Evaluating the potential returns on Dot Crypto investments is crucial for investors considering the Dot Crypto price. By analyzing market trends and assessing the long-term prospects of this cryptocurrency, investors can make informed decisions about their investment strategies.

Are you considering investing in Dot Crypto? Wondering about the potential returns and opportunities it offers? Look no further. In this section, we will explore the factors to consider when evaluating the potential returns of Dot Crypto investments. From comparing Dot Crypto with traditional investment opportunities to projecting growth and ROI calculations, we’ve got you covered.

Let’s dive in!

Comparing Dot Crypto With Traditional Investment Opportunities

When it comes to evaluating potential returns, it’s essential to compare Dot Crypto with traditional investment opportunities. Consider the following:

- Market Volatility: Dot Crypto is known for its volatility, offering both opportunities and challenges. Traditional investments tend to have more stable market conditions.

- Liquidity: Traditional investments often offer better liquidity compared to Dot Crypto, which can experience fluctuations in trading volumes.

- Potential Returns: Dot Crypto has the potential for higher returns compared to some traditional investment opportunities due to its growth potential and increasing adoption.

Projected Growth And Roi Calculations For Dot Crypto Holdings

Now, let’s explore projected growth and ROI calculations for Dot Crypto holdings. Here are some key points to consider:

- Historical Performance: Analyze the historical performance of Dot Crypto and its price trends to identify potential growth patterns and assess risks.

- Market Analysis: Study the market demand for Dot Crypto and the factors driving its growth, such as increasing adoption by businesses and investors.

- Industry Trends: Stay informed about the latest trends in the cryptocurrency industry, such as new developments and partnerships that may impact Dot Crypto’s growth potential.

- ROI Calculations: Evaluate the potential return on investment based on the current price, anticipated price movements, and your investment time frame.

Remember, conducting thorough research and consulting with financial experts can help you make more informed decisions regarding your Dot Crypto investments.

Long-Term Vs Short-Term Investment Strategies For Dot Crypto

Deciding between long-term and short-term investment strategies for Dot Crypto is crucial. Here are some insights to guide your decision-making process:

- Long-term Strategy: If you believe in the long-term potential of Dot Crypto, consider holding your investments for an extended period. This strategy can benefit from potential future price appreciation and the gradual expansion of the cryptocurrency market.

- Short-term Strategy: Alternatively, short-term trading strategies involve taking advantage of price volatility and quick price movements in Dot Crypto. This approach requires active monitoring and analysis of market trends.

Ultimately, your chosen investment strategy should align with your risk tolerance, financial goals, and timeframe for potential returns.

Keep in mind that investing in Dot Crypto, like any other investment, comes with risks. It’s essential to evaluate your risk tolerance and carefully consider your investment decisions.

So, whether you’re comparing Dot Crypto with traditional investments, calculating potential growth and ROI, or deciding on a long-term or short-term strategy, understanding the potential returns on Dot Crypto investments is crucial. Make informed choices and seize the opportunities that this exciting cryptocurrency offers.

Regulatory Climate And Its Impact On Dot Crypto Price

The regulatory climate has a direct impact on the price of Dot Crypto, with potential changes in regulations affecting its value.

As the domain of cryptocurrencies continues to evolve, the regulatory landscape plays a significant role in shaping the prices of digital assets like Dot Crypto. Government regulations not only influence market sentiment but can also introduce challenges and opportunities for investors.

Understanding how legal frameworks impact Dot Crypto price movements is crucial for anyone looking to navigate this dynamic market successfully. Let’s delve into the various aspects of global Dot Crypto regulation and its effects.

Government Regulations Influencing The Dot Crypto Market:

- Regulatory uncertainty: Lack of clear guidelines and regulations surrounding cryptocurrencies can create market volatility and hinder investor confidence.

- AML and KYC requirements: Government-mandated anti-money laundering (AML) and know your customer (KYC) regulations for crypto transactions can impose additional compliance obligations on market participants.

- Taxation policies: Tax rules imposed by governments on crypto-related activities can directly affect the buying, selling, and holding of Dot Crypto, impacting its supply and demand dynamics.

How Legal Frameworks Shape Dot Crypto Price Movements:

- Regulatory clarity: When governments establish transparent regulations for cryptocurrencies, it can foster trust and stability in the market, potentially driving up the price of Dot Crypto.

- Investor protection: Regulatory frameworks that emphasize investor protection may attract a larger pool of investors, expanding the user base and potentially increasing the demand for Dot Crypto.

- Market manipulation prevention: Regulations aimed at preventing market manipulation, fraudulent schemes, or insider trading can enhance market integrity, fostering investor confidence and positively impacting Dot Crypto prices.

Challenges And Opportunities In Global Dot Crypto Regulation:

- Regulatory fragmentation: The global regulatory landscape for cryptocurrencies is currently fragmented, with different countries adopting varying approaches. This lack of harmonization can create challenges for individuals and businesses operating across borders.

- Emerging trends: As cryptocurrencies gain prominence, governments around the world are actively exploring and adapting their regulatory frameworks to accommodate this emerging technology. This presents opportunities for individuals and businesses to participate in shaping the regulatory environment.

- Innovation and collaboration: Balancing innovation with regulatory clarity is essential to sustain the growth of the Dot Crypto market. Collaborative efforts between government entities, blockchain companies, and industry stakeholders can lead to favorable regulatory outcomes.

Navigating the regulatory climate is a critical factor influencing the price movements of Dot Crypto. As governments continue to grapple with the complexities surrounding cryptocurrencies, market participants must stay informed about the evolving legal frameworks and their potential impact. By closely monitoring regulatory developments, investors can adapt their strategies to seize opportunities and mitigate risks in this rapidly evolving landscape.

Overcoming Regulatory Obstacles For Profitable Dot Crypto Investment

Investing in Dot Crypto can be highly profitable, but navigating regulatory obstacles is key to success in this field. Overcoming these challenges is essential for managing the fluctuating Dot Crypto price and maximizing returns.

Dot Crypto Price:

The world of cryptocurrency is continuously evolving, presenting unique opportunities and challenges for investors. In the case of Dot Crypto, it is essential to navigate the regulatory landscape effectively to maximize profits and mitigate risks. This blog post will explore three strategies to overcome regulatory obstacles and build a profitable Dot Crypto investment portfolio.

Adapting To Changing Regulatory Landscape

As governments begin to enact new regulations around cryptocurrencies, investors must stay abreast of these changes and adapt their strategies accordingly. Here are some key points to consider:

- Stay Informed: Keep a close eye on global regulatory developments and subscribe to reliable cryptocurrency news sources to stay updated.

- Understand Compliance Requirements: Familiarize yourself with the regulatory compliance requirements for investing in Dot Crypto, such as KYC (Know Your Customer) procedures and AML (Anti-Money Laundering) regulations.

- Assess Jurisdictional Impact: Different jurisdictions may have varying regulations concerning cryptocurrencies. Consider the potential impact these regulations may have on your Dot Crypto investments.

Utilizing Decentralized Exchanges To Mitigate Regulatory Risks

Decentralized exchanges (DEXs) offer a viable solution to mitigate regulatory risks associated with centralized exchanges. Here’s why you should consider utilizing DEXs:

- Pseudonymity: DEXs prioritize user privacy by enabling investors to trade cryptocurrencies without revealing their personal information, ensuring compliance with regulatory requirements.

- Transparent Smart Contracts: DEXs leverage smart contracts, which are self-executing contracts that automatically enforce agreed-upon terms. This transparency reduces the risk of regulatory non-compliance or fraudulent activities.

- Digital Wallet Security: By using DEXs, investors can retain control over their private keys and funds, minimizing the risk of hacks or theft associated with centralized exchanges.

Diversifying Dot Crypto Portfolio To Reduce Regulatory Dependency

Diversification is a fundamental strategy to reduce regulatory dependency and associated risks. Here’s how diversifying your Dot Crypto portfolio can help:

- Explore Different Cryptocurrencies: Consider investing in a variety of cryptocurrencies beyond Dot Crypto alone. This diversification can help minimize the impact of regulatory changes specific to a single cryptocurrency.

- Allocate Across Multiple Wallets: Distribute your Dot Crypto holdings across multiple wallets to reduce the risk of regulatory restrictions affecting your entire portfolio. This approach ensures that any potential regulations only impact a portion of your investment.

- Consider Traditional Investments: Broaden your investment strategy by including traditional investments alongside Dot Crypto. This diversification can help mitigate risks associated with specific industries or regulations.

Navigating the regulatory landscape is vital for a profitable Dot Crypto investment. By staying informed, utilizing decentralized exchanges, and diversifying your portfolio, you can overcome regulatory obstacles and position yourself for success in the world of cryptocurrencies.

Frequently Asked Questions Of Dot Crypto Price

What Is Dot Crypto?

Dot Crypto is a top-level domain (TLD) introduced by Unstoppable Domains that leverages blockchain technology. It allows users to create and manage decentralized websites and domain names using the Ethereum blockchain. Dot Crypto domains are censorship resistant and offer greater security and privacy compared to traditional domain names.

How Can I Buy Dot Crypto?

To buy Dot Crypto domains, you can visit the Unstoppable Domains website and search for the desired domain. Once you find a domain you like, you can proceed to purchase it using cryptocurrencies such as Bitcoin or Ethereum. The process is simple and user-friendly, making it accessible to both crypto enthusiasts and beginners.

What Are The Advantages Of Using Dot Crypto Domains?

Dot Crypto domains offer several advantages over traditional domains. They are resistant to censorship and cannot be seized or taken down. Additionally, these domains enable true ownership, allowing you to fully control your online identity and content. Dot Crypto domains are also interoperable with various blockchain-based services, providing more possibilities and flexibility for website owners.

Are Dot Crypto Domains Seo Friendly?

Yes, Dot Crypto domains are SEO friendly. While search engines may not fully support blockchain domains yet, there are ways to optimize your website for search engines. By focusing on high-quality content, relevant keywords, and backlink building, you can still improve your website’s ranking on search engine result pages (SERPs) and drive organic traffic to your Dot Crypto domain.

Conclusion

The Dot Crypto Price has the potential to revolutionize the way transactions are conducted in the digital world. With its decentralized nature and the use of blockchain technology, it offers a secure and efficient platform for storing and transferring digital assets.

As we have discussed throughout this blog post, Dot Crypto Price offers several advantages over traditional methods of transaction. It eliminates the need for intermediaries, reduces transaction costs, and increases transparency and security. Furthermore, the growing popularity of cryptocurrencies and the increasing adoption of blockchain technology indicate a promising future for Dot Crypto Price.

As more people and businesses recognize the benefits it offers, we can expect to see an increase in its value and usage. It is important to keep in mind that, like any investment or technology, there are risks involved with Dot Crypto Price.

It is crucial to stay informed and make educated decisions when it comes to investing or using this cryptocurrency. Overall, Dot Crypto Price provides an exciting opportunity for individuals and businesses to participate in the digital economy and embrace the future of finance.